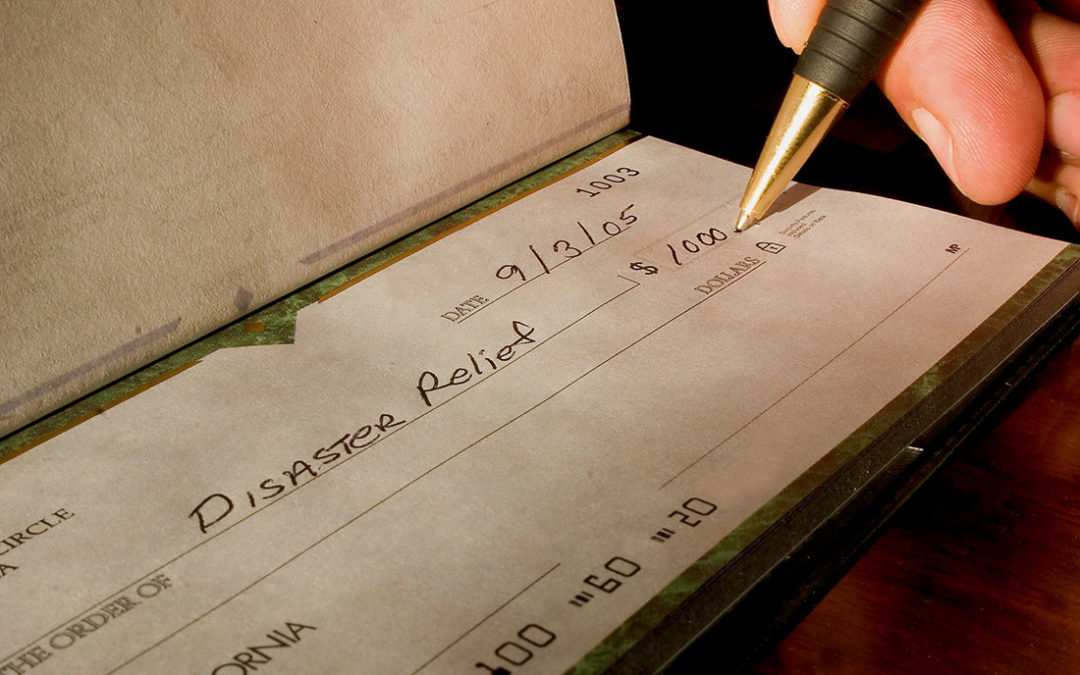

Donations to a qualified charity are generally fully deductible, and they may be the easiest deductible expense to time to your tax advantage. After all, you control exactly when and how much you give. But before you donate, it’s critical to make sure the charity you’re considering is indeed a qualified charity — that it’s eligible to receive tax-deductible contributions.

The IRS’s online search tool, Exempt Organizations (EO) Select Check, can help you more easily find out whether an organization is eligible to receive tax-deductible charitable contributions. You can access EO Select Check at https://apps.irs.gov/app/eos. Information about organizations eligible to receive deductible contributions is updated monthly.

Please keep in mind that the listing will only include charities that have approved exempt status with the IRS. Some churches and other religious organizations are not required to apply for exempt status and will not be listed on the IRS website.

Also, with the 2016 presidential election heating up, it’s important to remember that political donations are not tax-deductible.

Of course, additional rules affect your charitable deductions, so please contact us if you have questions about whether a donation you’re planning will be fully deductible. We can also provide ideas for maximizing the tax benefits of your charitable giving.